Why the FSPO refers complaints to other European countries

Provision of financial services to consumers in Ireland from another European country

The functions of the FSPO are governed by the provisions of the Financial Services and Pensions Ombudsman Act 2017, as amended (“the Act”). The FSPO can investigate any consumer complaint made about the conduct of a “financial service provider” which has a specific definition under the Act, and which makes reference to the separate provisions of the Central Bank Act 1942, as amended.

This definition includes financial service providers that are regulated in this country by the Central Bank of Ireland. It also includes other financial service providers which are regulated by a competent regulatory authority in another member state of the European Economic Area (EEA), but which provide services across EU borders, to make their services available to Irish consumers on what is known as a “freedom of service” basis. This is also referred to as “passporting”.

When investigating complaints, the FSPO must consider the regulatory status of the financial service provider whose conduct is the subject of the consumer complaint, to ensure that it is a regulated entity meeting the definition under the Act.

In addition, however, the FSPO must also consider the particular law which is specified by the contract, to be the governing law of that contractual arrangement in place between the consumer and the financial service provider.

Financial services contracts held by consumers, that are not governed by Irish law

When the consumer contract is not governed by Irish law, the FSPO cannot investigate and adjudicate on that complaint, as this would call for the FSPO to interpret and apply the laws of a foreign jurisdiction, in the course of an investigation under the Act, leading to a legally binding outcome.

When that happens, the FSPO will refer the complainant to the appropriate Alternative Dispute Resolution (ADR) body in the relevant country as the competent authority to adjudicate the complaint in relation to the contractual issue arising.

This includes referrals to ADR bodies within the EEA area, in accordance with the FIN-NET Memorandum of Understanding on a Cross-Border Out-of-Court Complaints Network for Financial Services.

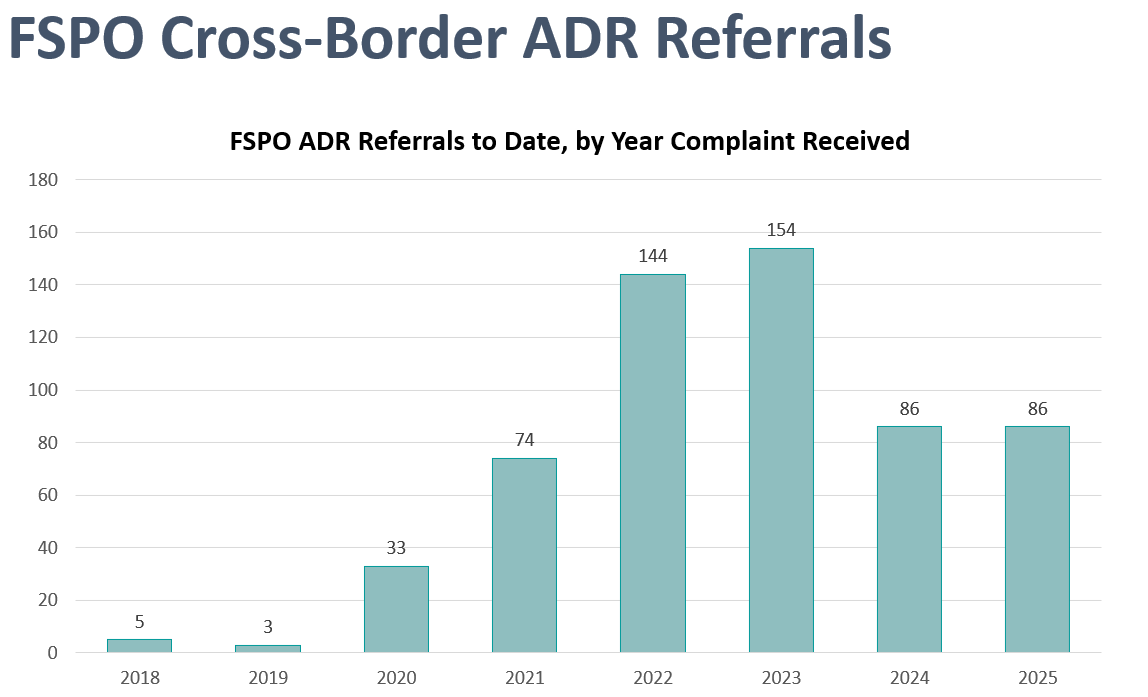

Over the last number of years, the presence of an increased number of financial service providers passporting into Ireland, from another jurisdiction, has given rise to a significant and increasing number of complaints received by the FSPO where, because of the governing law of the contract, the FSPO cannot offer its services and must instead refer the matter to a different ADR body in another country.

The FSPO anticipates that with the potential expansion of services being made available from providers passporting from other jurisdictions, the number of such referrals to other ADR bodies, has the potential to very significantly increase. The table below sets out the increasing number of such complaint referrals by the FSPO to other ADR bodies since 2018, to end of December 2025.

Detailed data table for screen readers

| Year | Complaints |

|---|---|

| 2018 | 5 |

| 2019 | 3 |

| 2020 | 33 |

| 2021 | 74 |

| 2022 | 144 |

| 2023 | 154 |

| 2024 | 86 |

| 2025 | 86 |

An alternative to referring the complaint to an ADR body in another European country

The FSPO will not progress a complaint where the contract is governed by the law of another jurisdiction. Where possible the FSPO will direct the consumer to an appropriate ADR body in that other jurisdiction.